ETFs that sound similar often have a surprising divergence of holdings.

The climb past 1,800 exchange-traded products has been driven by a fair amount of innovation — and seemingly quite a bit of duplication. Many of the newer products seem to compete directly with established funds, with very few differences.

This is especially true among the growing lineup of “smart beta” ETFs (also commonly known as “strategic beta” or “factor ETFs”), which are multiplying in numbers. Many of these ETFs that feature almost identical names have portfolios with surprisingly little in common.

Quality ETFs

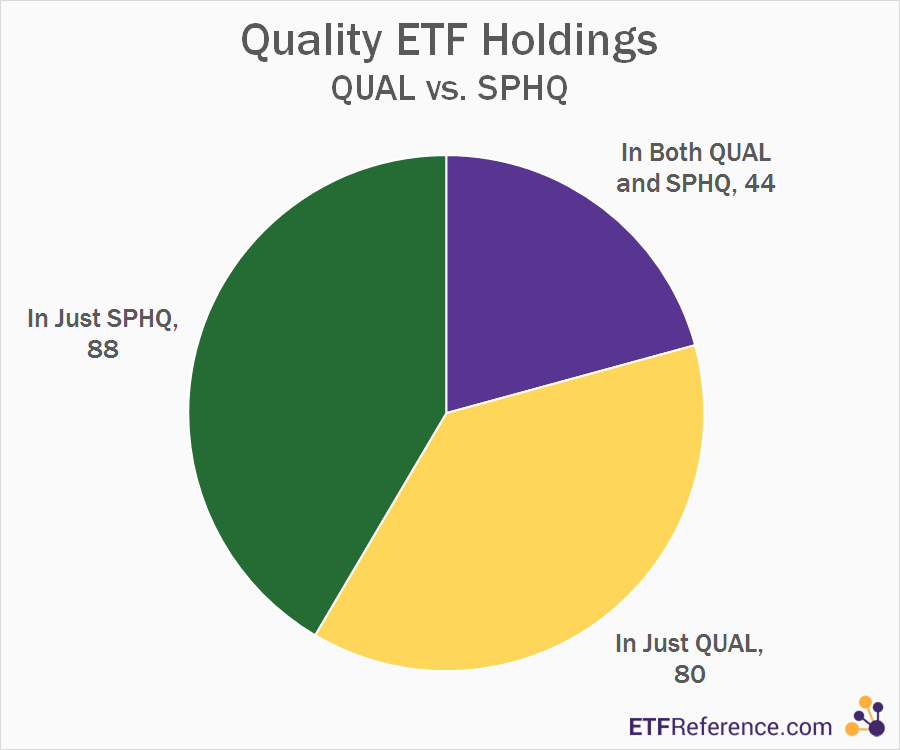

The iShares MSCI USA Quality Factor ETF (QUAL) and PowerShares S&P 500 High Quality Portfolio (SPHQ) both seek to identify large-cap stocks that meet certain “quality” criteria, including the stability of earnings. But the methodologies employed are clearly not identical, as evidenced by the composition of the portfolios.

There are just 44 stocks that are in both the QUAL and SPHQ portfolios, and these common components make up less than half of each portfolio.

Among the stocks that are found in just one of the two quality ETFs are Apple (AAPL), General Electric (GE), and Wells Fargo (WFC).

Quality Dividend ETFs

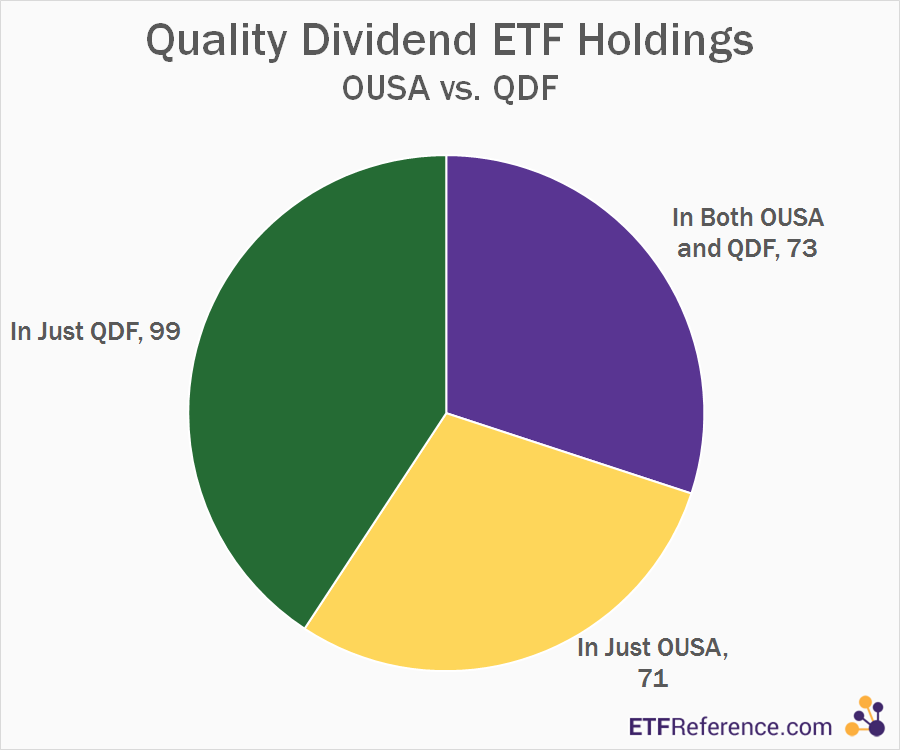

It’s a similar story for a pair of more focused “quality” ETFs, the O’Shares FTSE US Quality Dividend ETF (OUSA) and the FlexShares Quality Dividend Index Fund (QDF). There are just 73 common components between these two; QDF has nearly 100 additional holdings that aren’t found in OUSA.

These two ETFs also disagree about Apple, which is included in QDF but not OUSA.

Low Volatility ETFs

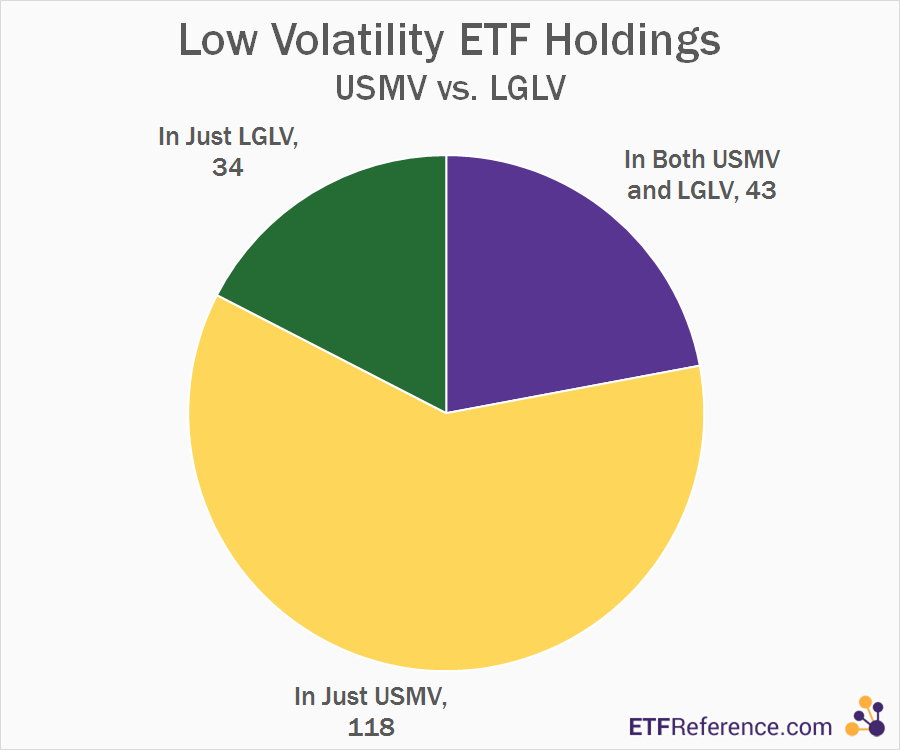

The definition of “quality” stocks is perhaps subjective; there are a number of different metrics that can be reasonably used to screen for stocks that are deemed to merit this description.

By comparison, low volatility strategies would seemingly leave less room for interpretation. But the overlap between the iShares MSCI USA Minimum Volatility ETF (USMV) and SPDR Russell 1000 Low Volatility ETF (LGLV) is hardly complete; there are just 43 stocks that are in both funds.

Among the 34 stocks that LGLV includes but USMV does not are General Electric (GE) and Disney (DIS).

Under the Hood

The differences in portfolios highlighted may not come as a surprise to most investors. And it certainly doesn’t mean that any of these ETFs is flawed; they’re just different. Once investors venture outside of cap-weighting, minor decisions on methodology can end up having a significant impact on the portfolio.

Many products that appear to be generally similar on the surface end up having very different results. But the lesson here is worth repeating: it often takes a detailed look under the hood to fully understand a how a fund implements its strategy.

About the Author: Michael Johnston

Michael Johnston is senior analyst for ETF Reference, and also serves as COO of parent company Poseidon Financial. His investment expertise has been featured in The Wall Street Journal, Barron’s, and USA Today, among other publications. He resides in Chicago.

Comments